This guide on financial independence, would be a pragmatic and practical guide to help you grow financially. It is not a guide on how to get rich quickly, instead we would follow a step by step processes that you can use to create wealth over time.

In this article we would learn to differentiate between earning a high income and being wealthy, the importance of paying tax, growing assets and targeting the right investment opportunities. This article attempts to help you learn useful tips to help you grow financially and become financially independent.

THE RIGHT TO BE RICH

No matter what anybody says, it is impossible for you to live a comfortable, happy or successful life if you are not rich. I have heard some people teach that not everyone needs to be wealthy, and I say that is bullshit.

The only way anyone can reach their full potential or make full use of their talent is by having access to a lot of things and the only way you can get those things is by creating wealth.

Everyone has a right to be rich. The reason for life is development, to grow and become better.

To be rich in the right sense of the word does not mean to be satisfied or content with whatever you have no matter how little.

According to the Merriam-Webster dictionary, this is the definition of rich:

- :having abundant possessions and especially material wealth

- a :having high value of quality

b :well supplied or endowed - :magnificently impressive: SUMPTUOUS

In my book, it is a crime to be content with less.

Everyone aims to be successful. What is success? Success is becoming what you want to be. You can only become that if you make use of resources. Those resources would be available to you only when you become rich enough to buy them. With this in mind, it is important that we all learn all tips necessary to grow financially.

It is normal for you to want to be rich even hunger for it. Anyone that tells you otherwise doesn’t have your best interest at heart.

Related reading: 11 Helpful Habits to Make Better Life Decisions

INCOME IS NOT WEALTH

The biggest mistake that most individuals make is believing that earning a high income is the key to getting wealthy.

The key to creating wealth is to spend less than you make.

Have you ever wondered why athletes who earn millions of dollars during their career end up getting bankrupt? It because they spend the money as fast as they make it.

You do not need to earn a massive pay check to become wealthy.

A janitor named Ronald Read who lived in Vermont showed that you can become a millionaire even if you earn a modest salary. When Ronald died at the age of 92 in 2014, he had over $8 million in bank. All these money was thanks to his amazing spending and investing habits.

It was even after his death that his family found about his wealth.

In their own words, they were “tremendously surprised”. His stepson Philip Brown had this to say about Ronald, “He was a hard worker, but I don’t think anybody had an idea that he was a multimillionaire.”

Read was never rich growing up. He was the first in his family to graduate from high school and he served in the theater during World War II. According to his friends, Read lived very frugally and only spent money unless he had to.

Mark Richards who was his friend and neighbor said, “I’m sure if he earned $50 in a week, he probably invested $40 of it.”

Read was also really good at finding the right stocks to invest in. He also had the ability to hold stocks for a long while.

Billionaire investor Warren Buffet recommends the strategy of holding stocks for a while before disposing them. At the time of death, Mr Read had at least 95 stocks which he had held for many years.

How do you then become more like Read? You have to understand that income is not long-term wealth.

What is wealth?

Wealth isn’t your total net worth at any given point in time. Wealth is your assets minus liabilities. Wealth is what you have left after liquidating.

Wealth = assets – liabilities

Read more: 10 Helpful Strategies for Finding your Purpose In Life

Long-Term Planning

To grow financially and accumulate wealth, it is important that you plan for long-term. What you would take into consideration when planning for long-term would not be the same for every individual.

The same planning an entrepreneur who owns his own business would make would differ from what someone who receives a salary working for a company would.

The salary you earn would majority of the time not translate into wealth unless you are the CEO of fortune 500 company.

If you worked for a firm, your long term planning would include ensuring job security, taking the required steps so that you can get promoted, having side gigs, investing a part of your salary in profitable ventures and stocks.

To take things up a notch, you can even start your own private business. You could open a car wash, parking garages, a food stand, a restaurant or a saloon.

There are several cash generators you can set up in addition to your salary to help you grow financially. Stocks, bonds, real estate, patents and trademarks are some things you can invest in.

Even when you are holidaying somewhere on the beach, your portfolio could still bring in money.

True financial independence would come from organic investments.

Organic investments are the kind that generate capital or dividends without any active labor put in place.

The more you acquire organic investments like this, the more financially independent you would become.

Read more: 22 Behaviours That Helps Improve Emotional Intelligence

LAWS OF GETTING RICH

There are laws which govern the process of making wealth. Once you begin to obey these laws, you increase your chances of getting rich.

There are certain things that you have to do to become wealthy. Some people do this on purpose while others do it accidentally. The one truth is that if you do not do this things, you would remain poor.

Wealth isn’t restricted to a certain geographical location.

If how much fortune you amassed is dependent on your environment, we would see some people in a town would be rich while the individuals in the adjoining town would be poor. This is not the case, instead we see both the rich and poor living side by side in the community.

Both the rich man and the poor man might even be engaged in the same occupation, but one lives in comfort and the other doesn’t.

Two men might be in the fishing business and in the same location. They fish in the same waters everyday but one of them is rich while the other is poor. This goes to show that you have to behave in a certain way in order to get rich.

A good environment might factor into the ease of making money but it isn’t a predominant factor.

Your ability to obey these laws is also not determined by how much talent you have. We see people with a lot of talent who remain poor and people with little or no talent making lots of money.

If you take a good look at rich people, you would notice that they do not possess more talents or abilities than the average man.

Some say getting rich depends on saving 90% of your wealth and spending as little as you can. This statement isn’t true because many thrift spenders are still poor while free spenders get richer.

From all these instances I have given, you would see there are laws – certain things that you should do that could help you create wealth.

Your natural ability does not factor into how rich you can become. Geniuses get rich, blockheads get rich, intellectual people amass wealth and stupid people also amass wealth, the strong gets rich while the weak can also get rich.

All you need is the ability to think and understand. Anybody who is able to read and understand what is written can create wealth.

Although I said environment does not make one rich, location also matters. It would be very foolish to go open a restaurant in the middle of the Sahara desert and expect it to be successful.

To grow financially it is important you deal with men, and of being where these men are. That is the role that environment plays in the whole process.

If there is a rich person in your community, you can also get rich. There is nothing stopping you from amassing wealth.

Subsequently, your job or occupation does not determine if you would get rich. There are also people in that same occupation as you that are wealthy. People are making wealth in all vocations while some are drowning in poverty in that same vocation.

Your location would also determine the kind of business that would be successful. Selling mackerel in an area where there are only salmon fishes would mean that you would have a large market all to yourself.

Aside from few limitations, getting rich is not determined by your environment but doing things in a certain way. If people are getting rich in your business and you are not getting rich, you should ask yourself why this is so. They must be doing some things that you are not doing yourself.

Lack of capital does not also prevent you from getting rich. If you already had capital to start any business you want, you are already rich.

Raising capital is part of the process of getting rich.

If you have no capital, you can get capital. If your business is wrong for you, you can get into the right business. If you are doing business in the wrong location, you can move to the right location.

Read more: How to Start a Blog in 17 Steps That Makes Money – Beginners Guide

ACTIVELY SEARCH FOR OPPORTUNITIES

Opportunities for getting rich isn’t monopolized.

No man is kept poor because a certain group of people have monopolized all the money making opportunities.

It is possible that you might be restricted from engaging in certain business because of government laws, but that isn’t the only kind of business available.

It is very true that if you are working under someone, you would never be as rich as the person you work for. But if you have a solid financial plan as well as goals, you can leave the employ of that person and start your own business and become rich yourself.

At different points in time, opportunities comes up – needs that people have and only a few are attending to. The few people attending to these needs are the ones creating wealth for themselves.

You need to learn to see new trending tides and the opportunities that live within them.

There is an abundance of opportunity for the man that goes with the tide, instead of trying to swim against it.

In an area where the predominant occupation is fishing, a lot of people would buy boats and get into the business of catching and selling fishes.

Some people would make a ton of money while others won’t.

But there are certain opportunities that you could use in creating wealth for yourself without a lot of competition and not being a fisherman yourself.

Instead of buying a boat and finding a fishing crew, why don’t you open your store that sells fishing equipment such as nets, hooks, bait and swimming gears. This is an opportunity that most people would overlook.

Your services would always be required by the fishermen which means a steady source of income for you. This is what I mean by going with the tide instead of trying to swim against it.

No one is kept poor because there is a scarcity of riches: there is enough wealth for everyone.

The way the earth was designed, there is enough resources that everyone could live in palaces, wear the best clothing and have enough food to live luxuriously.

The supply of resources on the earth is inexhaustible. No man on earth is poor because the resources on nature is scarce, or because there isn’t enough for everyone to go around.

Jeff Bezos: he saw an opportunity in making shopping easy and accessible to everyone and he created the world’s online marketplace – Amazon.

Bill Gates: he saw an opportunity in making computers affordable and accessible to everyone and not only big corporations like IBM and NASA. He created Microsoft which has made him the second richest man on the planet.

It is only by actively searching for opportunities around you that you would see avenues through which you can grow wealth and become financially independent.

THE PRINCIPLE OF THOUGHT

thought:

noun: thought plural noun: thoughts

- An idea or opinion produced by thinking, or occurring suddenly in the mind.

- An intention, hope, idea of doing or receiving something.

- The action or process of thinking

- The formation of opinions, especially as a philosophy or a system of ideas, or the opinions so formed

Thought is the only power that produce tangibles riches from a formless substance.

There is a lot of power in how we think.

If we think of ourselves as financially independent individuals, it would not cause an instant flow of cash and wealth, but instead it would cause a flow of creative energies that would result in us finding those avenues that would make that thought a reality.

What differentiates humans from every other being on this planet is creative thought.

Man is a thinking center and we are the only life on the planet that can originate thought. All that would be manifested in your life must first be thought of.

You cannot create wealth unless you have first thought of it.

It is only those who can think that would be able to create, and it is only those who can create that would be able to get wealth.

Read more: Productivity System: The Definitive Guide (2019)

MONEY MAKING CHARACTERISTICS

Check out a list of characters that you should have in order to grow financially.

Has a Plan of Action

Individuals who are financially intelligent have a detailed plan of action that they implement daily without fail.

They have a set of goals that they target. This smaller goals keep them in check and serves as a marker towards the bigger goal of financial independence.

The save up to 10% of their income

A financially intelligent person would save up to 10% of their income. These savings would then be used for either investments purposes or compound the money for their long term goals.

Reduce the amount of liabilities they purchase

A financially intelligent individual understands that purchasing things that would be a liability would only serve to deter their chances of creating wealth in the long run.

In the instance when they must purchase a liability, they would ensure that they do so at the lowest possible price possible.

The smartest ones would only purchase liabilities only from the profits they make from smart investments.

They have long term and money short term goals

Having money goals would allow you know which steps of action to take. It provides you with motivation that keeps you focused on your dream of creating wealth.

They spend money with a plan

Any expense that a financial intelligent individual makes is done strategically. Every purchases is done carefully with its pros and cons carefully accessed.

They understand that even the smallest purchases that you make today can have a positive or negative ripple effect in the long term.

They know that accumulating a ton of small purchases can either cause them to be in debts or bring profits in the long run.

Financially intelligent people make use of foresight. They analyze the effect of whatever purchase decision they are about to make on the future and see if the consequences are justifiable.

If the consequences in the future would not bring any long term profits, they re-analyze and determine another route of action.

They Seek Financial Advice from Professionals

A very classic characteristic of money makers is that they understand that they don’t know it all. So they go ahead and seek financial advice from professional experts who have a good history of financial success.

They Interact with other Financial Intelligent Individuals

To grow financially, you would have to relate with financial independent people.

This would allow you to learn their habits, thought processes and daily rituals that make them successful.

This is the reason why financially intelligent people interact with money managers so that they can gain knowledge before they make any major financial decisions themselves.

They Keep Learning New Ways to Make Money

A financially intelligent person never stop learning new strategies on how to make money.

Daily they refresh their knowledge on the best investment opportunities, the best properties for sale on the market, the stocks with the highest dividends etc.

To them, learning about money is a way of life. They find time to listen to podcasts, read books, attend financial seminars and speak to people about money.

Money is their way of life which is the reason why they are successful with money.

Read more: 9 Personal Development Goals For Growth and Success

CHARACTERISTICS OF THE FINANCIALLY INDEPENDENT

The same way there are money managers and people who are financially intelligent, we also have people who are financially dependent.

Check if you have any of this traits and eliminate them.

They Purchase Liabilities

Financially dependent people unlike financially intelligent individuals are drawn to making constantly purchasing liabilities. They are prone to making emotional purchases that would lose them money in the long run.

They do not Save and Spend the Little Savings they have

Financially dependent people would make any purchase without any inclination to keep some savings. They enjoy the instant gratification they get from making these purchases and never think of the long term effects.

This kind of habit causes them to live from paycheck to paycheck. Whenever they earn money, they do not waste anytime in spending it.

The times when there is no flow of money, they do now reduce their spending habits instead spend their savings or make use of credit cards. Hence putting themselves in further debt.

They do not have Money Goals or Plans

Incompetent money managers do not know the importance of having money plans or goals and hence they neglect them. They do not have any financial plans set up to help them move from debt and into abundance.

They Reject Financial Advice

First they believe that they know everything and do not need help from anybody regarding their finances.

Secondly, they do not want to spend money on professional financial advisors until they see the money in their bank accounts.

They do not realize that to create wealth in the long term, you would need to spend some money now. This money spent would come in the form of knowledge and advice that would lead them towards wealth creation.

Read more: Control Your Habits by Understanding Them

ASSETS VS LIABILITIES

What are Assets?

Assets are things that you own that keep paying you dividends for a long time. A good example of assets are investments.

Companies and individuals invest in bonds, equities, stocks and several other investment opportunities. These investments allows them to collect interest on the money that they have invested.

Investments are very important assets because they allow you to access direct cash flow.

TYPES OF ASSETS

Current Assets

This are the kind of assets that can be turned into liquidity within the space of a year. When balancing your account, current assets are usually place at the top.

Here are the kind of assets that can be classified as current assets:

- Cash & Cash Equivalents

- Short Term Investments

- Assets that are held for sale

- Foreign Currency

- Inventories

- Prepaid Expenses

- Current Income Tax Assets

Fixed Assets

These are also called “Non-current Assets”. They cannot be converted into cash in short term but they provide very huge benefits to the owner in the long run.

These are the kind of assets that are considered as “Fixed Assets”:

- Employee Benefit Assets

- Associate & Joint Investment Assets

- Goodwill

- Deferred Tax Assets

- Financial Assets

To find your total balance when doing a balance sheet, to get your total assets, you add the current and fixed assets.

Tangible Assets

These are the kind of assets that have physical attributes. They can be touched and felt. Examples are –

- Cash

- Land

- Buildings

- Plants & Machinery

- Equipment

- Inventory

Intangible Assets

These kind of assets have a lot of value but they do not have any physical attributes. Examples are –

- Patent

- Copyright

- Trade-will

- Goodwill, etc.

Fictitious Assets

Fictitious assets are not really assets. The word fictitious means fake or not real. So these are fake assets.

Fictitious assets are usually losses or expenses made. These losses or expenses are added to the balance sheets as assets because they could not be paid off within a year.

Example of fictitious assets include:

- Promotional expenses

- Preliminary expenses

- Loss on issue of debentures

- Discount allowed on issue of shares

LIABILITIES

What are Liabilities?

Liabilities are things that a company or an individual is obligated to. For example when you borrow a loan from a bank, the loan becomes a liability to you.

Types of Liabilities

There are two main types of liabilities. Let’s check them out:

Current Liabilities

These kinds of liabilities are also called “short-term liabilities”. These are the type that can be paid off within a year. Let us check out some of them:

- Short Term Financial Debts

- Current Income Tax Liabilities

- Provisions

- Deferred Revenue Income

- Short Term Loan

- Customer Deposit in Advance

- Liabilities directly associated with assets held for sale

- Interest Payable

- Sales Taxes Payable, etc.

Long Term Liabilities

There are also known as “non-current liabilities”. They are the type that take a long time to pay off.

Look at some items that could be considered as long term liabilities:

- Long Term Financial Debt

- Employee Benefits Liabilities

- Deferred Tax Liability

- Provisions, etc.

To get your “total liabilities” in your balance sheet, you add “current liability” with “non-current liability”.

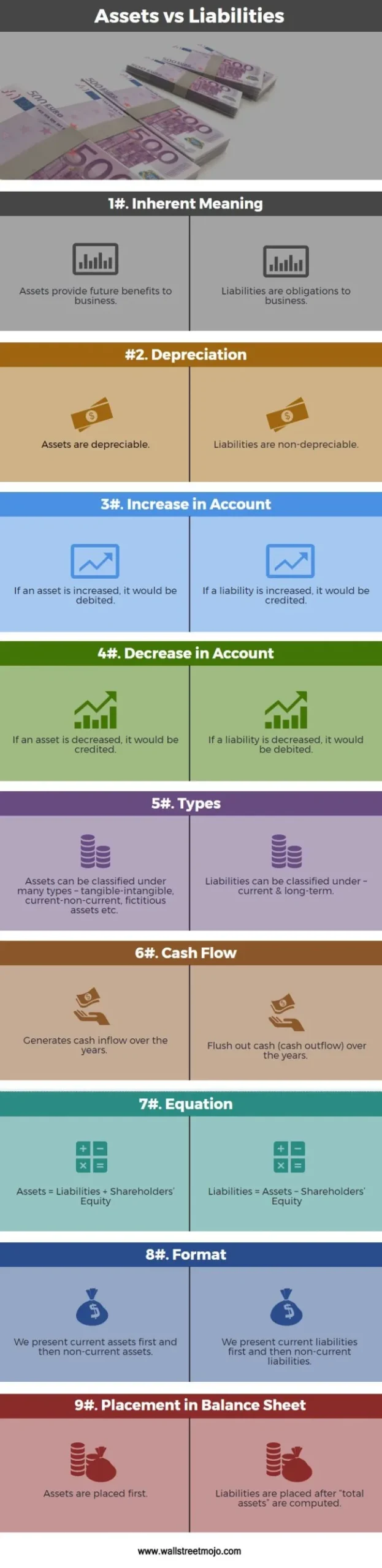

Key Differences Between Assets & Liabilities

These are the most important difference between assets and liabilities:

- Assets are things that would be paid off after a short period of time. Liabilities are things that would make a business obligated for a long period of time.

- Assets are debited when increased and credited when reduced. Liabilities are credited when increased and debited when decreased.

- Fixed assets are depreciated and lose their value. The only fixed assets that does not lose value over time is “Land”. Liabilities do not lose value over time but have to paid off whether in the long or short term.

- Assets generate cash flow for a business. Liabilities cause cash outflow.

- Assets are gotten with the motive of growing a business. Liabilities are gotten with the hope that you can acquire more assets so that the business would need less liabilities in the future.

If you want to grow financially and become financially independent, then you must ensure to have more assets that liabilities.

Read more: How to Focus Better and Increase productivity in 8 Sweet Steps

INVESTING THE RIGHT WAY

If you are really want to grow financially, then you must do more than just earn money.

Not only do you need to earn money, you must learn how to hold onto this money and also grow it.

How do you grow your money? You learn how to invest.

As an investor, you would use the money you earned to purchase things that would generate profits for you in the long term.

You learn to direct your limited resources to services that would would offer you potentially huge returns.

With how advanced technology has gotten, you do not need a lot of money to start investing. You can start invest with as little as $5 a month on your smartphone.

In this chapter you would learn the basics that would help you make better investment decisions.

Why Should you Invest?

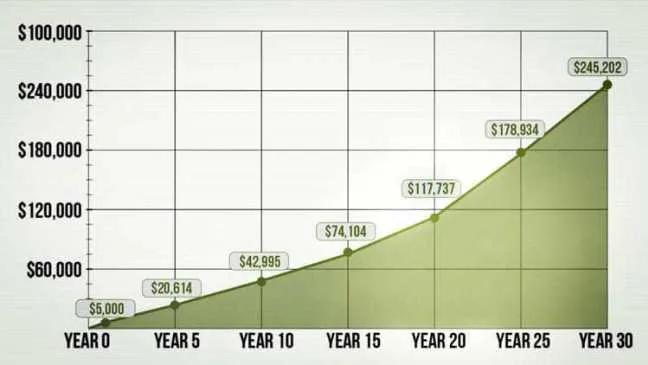

Investment allows you to grow your money and hence wealth over time. This is all thanks to compound interests.

Because of the power of compound interest, a few dollars can be worth millions of dollars some years down the line.

For example, if you invest $5000 into an account with an interest rate of 7 percent when you were 16 and add an extra $200 dollars every month, after 30 years that investment would be worth a little over $245,000.

For a more realistic example. If you invested $50 dollars into a 401k at 22 with a 50 percent company match, you would have $1 million when you are 65 if you raise contributions by the same amount as any pay raises. This is assuming that you have an annual raise of 3.5 percent and a 401k investments return of 8.5 percent.

This examples shows you the power of compound interest and the effect it can have on your finances.

When is the Right Time to Invest?

Very Simple. The right time to invest it now! There is no bad time or good time when it comes to investments.

There is always a risk of loss, but there is even a greater advantage of making big profits.

When it’s your first time investing, it might seem intimidating. No need to fear, there are several steps you could take to increase success and minimize chances of loss.

Risk & Rewards of Investing

I can’t tell you that there is no risk when it comes to investing because I would be lying.

We’ve heard of people losing more than of half of their wealth during the Great Depression and people who have lost money to investment scams. Although there are risks, you can reduces the chances of risk significantly if you invest the right way.

What I usually tell people is that it is much profitable to lose some money on bad investments that not investing because that would cost you a lot much more.

For the younger people it is also better to start investing now. You learn valuable lessons that would help you towards more serious investments – like your retirement funds.

A lot of people lose money because they invest in quick fix-trade stocks without really knowing what they are doing.

The number 1 rule of investing – the sooner money you start to invest, the more money you would make over time.

An individual who started investing at 20 would make more money in theory than someone who started investing at 30.

What Should You Invest In?

It is better to diversify your investments portfolio. This helps you limit risk and losing your entire investments.

The most successful investors do two things:

- They properly diversify and allocate their assets. Their investment portfolio contains a good mix of bonds, stocks, mutual funds and cash.

- They make use of an automatic investment plan. This reduces the chances of making mistakes that could be caused by emotions. A rumor of market crash can cause you to sell your stocks which in the end could have been a terrible decision.

Let’s see a brief explanation of various investments options.

Mutual Funds

This is a kind of option that pools your money in the same investments as other investors. The money that you and the other investors has put in the pool would then be used by the money managers to purchase securities for the group.

When you are just starting out as investors it is best to invest in mutual funds or exchange-trade funds.

With mutual funds you would be able to invest in a wide portfolio of stocks and bonds in one transaction rather than trading on each of them individually by yourself.

Not only are they one of the safest ways to invest, they are more cheaper because you would be paying just one commission or nothing at all when you buy from the company that sells the mutual funds.

Bonds

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental).

Bonds are used by companies, states, government and municipalities to finance new projects and operation.

Owners of bonds are called debt-holders, creditors, of the issuer. When you buy a bond, it would include details of when you would get paid along with the variable or fixed interests.

Retirement Accounts

With an IRA, you get tax advantages that serves an incentive towards retirement. The only downside is that there is a limit to how can put into the account yearly and how much you can withdraw.

There are 3 major types: 401k, traditional IRa and Roth IRA.

Real Estate

Real estate investment is a long term investment that ensures continuous cash flow. Your cash flow would also increase also time because rent would increase due to inflation.

You also do not need to own a home before you can go into real estate investment. You can buy real estate-focused ETFs through a broker.

Crowd-funding

Crowd-funding would allow you to invest in peer-to-peer ventures like lending and real estate. Fundrise is a popular Crowd-funding platform.

HABITS TO DEVELOP THAT HELP YOU GROW FINANCIALLY

1. Make Your Savings Automatic:

Your savings should be a priority. Before you start paying any bills, make sure that you have set aside some money for savings.

Automate your savings by setting up a ways that a part of your salary is transferred to a checking account after you are paid (you can try an online savings account). Just automate this process and forget about it.

2 Do not Spend Impulsely:

Impulse spending is a problem that many of us have.

The urge to eat out, spend on online shopping and other luxuries you can live without.

Learn to stop spending impulsively because it breaks your budget and sometimes even lead to debt that hinders your ability to grow financially.

3 Invest in your future:

Earlier in this guide, I have spoken about the importance of investments. This is one of the habits that you must have to grow financially and become financially independent.

4 Have an emergency fund:

This is very important so that in case anything happens, you have money to take care of it. It is also important you get life insurance for youself, spouse or anyone dependent on you.

5 Have a budget

Budgeting is very important. It helps you to easily track your expenses and avoid debts.

Before you run out of money, you already know.

6 Educate yourself

You never stop learning because things and trends change everyday. It is important you educate yourself on personal finance. The more you educate yourself, the better you would grow financially.

If this article on how to grow financially was helpful, check out this list of articles that can help you every aspect of life.

Ready to get your life back on track?